net investment income tax 2021 proposal

NET INVESTMENT INCOME. As noted above the house tax proposal expands the Net Investment Income Tax NIIT of 38 in order to cover net investment income which is derived from a trade or business for high income taxpayers but also further imposes this.

Like Kind Exchanges Of Real Property Journal Of Accountancy

On September 13 2021 the House Ways and Means Committee released proposed legislation that includes a host of tax increases focused on high-income individuals and corporations.

. Fortunately there are some steps you may be able to take to reduce its impact. The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and expansion of the 38 net investment income tax would be effective beginning in 2022. Those rates currently range from 10 to 37 depending on your taxable income.

The Build Back Better Act proposes the new net investment income NII to be 38 tax for trade or business income for taxpayers earning more than 400000 annually 500000 for married filing jointly. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax. We can forget about updated tax brackets the 25 maximum capital gains rate the refundable child tax credit extension past 2022 the death of the back door Roth and the defective grantor trust.

This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers. Trusts are hit hard The 38 surtax kicks in at much lower income levels for trusts. Your additional tax would be 1140 038 x 30000.

Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Net investment income tax. Plan ahead for the 38 Net Investment Income Tax 612021 Highincome taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

Fortunately there are some steps you may be able to take to reduce its impact. However in determining his self-employment tax T cannot use the FEIE amount to reduce his self-employment. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Single individuals with modified adjusted gross incomes in excess of 200000 and married individuals filing jointly with modified adjusted. Fortunately there are some steps you may be able to take to reduce its impact.

A separate proposal would first increase the top ordinary individual income tax rate to 396 434 including the net investment income tax. Net Investment Income Tax NIIT presents a big planning opportunity. All other threshold amounts are NOT indexed for.

Jun 20 2021 Blog Individual Taxes Taxes High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. The NIIT applies to you only if modified adjusted gross income MAGI exceeds.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. The threshold for trusts and estates is the amount at which the top trust tax bracket takes effect. A the undistributed net investment income or B the excess if any of.

The proposal eliminates a perceived loophole by subjecting all trade or business income of individuals with earnings over 400000 individual or 500000 married couples to the 38 net investment income taxexcept to the extent already subject to self-employment tax. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. Plan ahead for the 38 Net Investment Income Tax.

July 7 2021. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Nearly all of the changes we saw in the September 13th tax proposal are gone.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Surtax on Net Investment Income. If combined with the Net Investment Income Tax taxpayers with an adjusted gross income over 1 million will face a long-term capital gains tax rate of 434.

Under current proposals the long-term capital gains tax would increase to the taxpayers highest marginal tax rate of 396 for those with adjusted gross incomes over 1 million. September 2021 Federal Tax Proposals. Net operating losses would no longer be accounted for in determining NII.

Your net investment income is less than your MAGI overage. Surcharge on High Income Individuals Trusts and Estates. All About the Net Investment Income Tax.

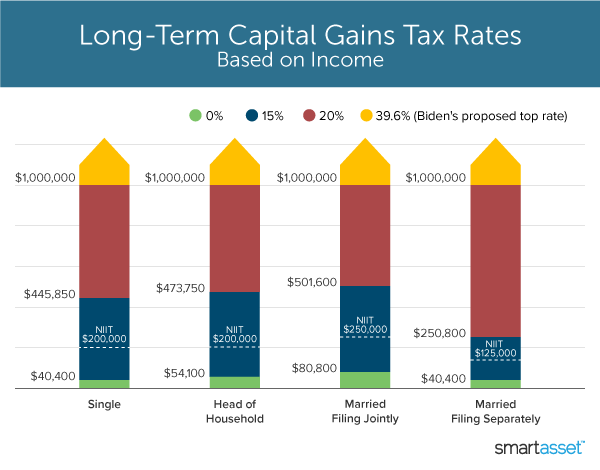

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or Qualifying widow er with a child 250000. Given the far-reaching impact of the proposed changes it is important to understand the current proposal.

Youll owe the 38 tax. Subject gifts and death transfers to capital gains taxes at the new rates above. Fortunately there are some steps you may be able to take to reduce its impact.

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. Fortunately there are some steps you may be able to take to reduce its impact. Interest dividends capital gains rental and royalty income and non-qualified annuities.

Plan ahead for the 38 Net Investment Income Tax Jun 18 2021 By Dukhon Tax In Income Tax Individual Tax Tax Tips High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. In general net investment income includes but is not limited to. Can push taxpayers over the income threshold and cause investment income to be subject to the 38 surtax.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. To see what rate youll pay see What Are the Income Tax Brackets for 2021 vs. Theres an additional 38 surtax on net investment income NII that you might have to pay on top of the capital gains tax.

Assume his net earnings from self-employment are US208700. This amount is 13050 in 2021. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021.

Investment Proposal Template Template Business In 2021 Sponsorship Letter Sponsorship Proposal Proposal Letter

What Is The The Net Investment Income Tax Niit Forbes Advisor

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

What S In Biden S Capital Gains Tax Plan Smartasset

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

It S Tax Time Implications Of Tax Reform For Banks Mercer Capital

Ulip Is Taxable Tax Free Investments Start Up Business Income Tax

Business Plan Index Sample Continuity Hotel Template Card Open Intended For Index Card Business Plan Template Word Startup Business Plan Daycare Business Plan

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Planningresizecssl Real Estate Investment Business Plan In Real Estate Investment Part Business Plan Template Free Business Plan Template Real Estate Investing

Capital Budgeting Introduction Techniques Process In 2021 Budgeting Budgeting Process Financial Health

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

How Biden S Build Back Better Hits Blue States Harder

Profit Sharing Calculator For A Startup Business Plan Projections Profit Shares Startup Business Plan How To Plan

Income Tax Calculator Facebook Will Before Long Change Its Name Another Report Proposes As It Looks To Show That It Has Extended In 2021 Income Tax Income Calculator

House Democrats Tax On Corporate Income Third Highest In Oecd

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting